What Is a Consumption Tax?

Although there is a sales tax in the U.S., it is a form of state tax, not a federal tax. In addition, state sales taxes exempt all sorts of spending, such as food, health, and housing. Countries that have implemented the sales tax as a federal consumption tax, tax almost all consumption. It’s worth noting that California has the highest sales tax in the nation, so this example would look quite different in other states.

- Since low- and middle-income households spend more of their income than wealthy households, the consumption tax can prove regressive.

- In addition to discouraging decisions to work, save, and invest, complying with existing income tax rules is very costly.

- After intergovernmental transfers — meaning funding from the federal government to the state governments — sales taxes account for the largest source of state tax revenue.

- The debate over alternative tax bases involves both philosophical arguments about what constitutes a fair measure of ability to pay and economic arguments about the relative efficiency of different tax bases.

- First, because a BAT does not tax the normal return to saving or investment, it is likely to stimulate additional saving and investment.

Are there exemptions from consumption taxes?

Using the same examples as above, a single parent with $5,000 in income and one child dependent would qualify for nearly $2,100 of tax credits under current law. A family of joint filers earning $35,000 with two child dependents would qualify for about $7,000 to $9,000 of tax credits currently, which would fall to $6,000 under the proposed reform. Embedding much of the social safety net in the income tax code, however, creates complexities for families and limits the effectiveness in providing support to households who do not file taxes.

Consumption tax

Though higher-income households save more, treating income neutrally no matter its use is completely separate from the distributional burden of a tax, as any tax type can be structured to meet various distributional goals. Taxes can be structured in many different ways with varying economic, administrative, and compliance costs. The sales tax is usually ad valorem, that is, it is calculated by applying a percentage rate to the taxable price of a sale.

There are exemptions that include food, newspapers, and some other daily items to keep the consumption tax at 8% for those items. A consumption tax bill is generally collected by a vendor from their customers and in turn forwarded to the state or federal authorities after a fixed period, usually monthly or yearly, depending on the jurisdiction and the law of the particular state. The United States used consumption tax before it shifted to a progressive tax regime and adopted the income tax. The Liberal Democratic Party government of Masayoshi Ōhira attempted to find strength in your numbers this tax season introduce a consumption tax in 1979.

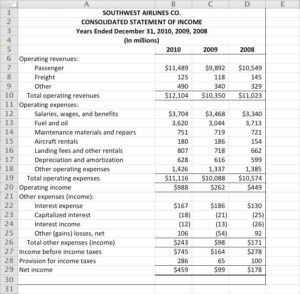

Example of Consumption Taxes

Two possible impacts are known as income effect (taxes reduce the real value of work) and substitution effect (changes in relative value of work in relation to other activities). Also, a consumption tax could utilize progressive rates in order to maintain “fairness”. A simple value-added tax is proportional to consumption but is regressive on income at higher income levels, as consumption tends to fall as a percentage of income as income rises. A value-added tax may exclude certain goods to make it less regressive against income.

As such, an income tax system double taxes or places a higher tax burden on future or deferred consumption. Such double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. It creates a tax penalty on saving and investment because income that is saved or quickbooks vs quicken: knowing the difference invested to consume in the future faces a higher tax burden than income that is consumed right away. Taxing income also requires complicated determinations on how to define income, which increases the complexity of the tax code and makes it harder for families to file their taxes and claim certain tax benefits.

Flat consumption taxes are regressive (shift the tax burden to the less well-off). Under the current income-based model, individuals and households are subject to a tax whether or not they are careful to set aside funds for the future. The consumption tax model reverses this paradigm, as money is only taxed when spent, which can encourage people to spend less and save more.

Consumption Tax: Definition, Types, vs. Income Tax

The extent to which the shift to cash compensation occurs is uncertain, however, and if the shift is only partial, it would raise less revenue than what our analysis assumes. If lawmakers excluded certain categories of goods or services from the VAT base, it would require a higher tax rate to generate the same revenue as the option we simulated. Within the 10-year budget window, the reform would reduce federal revenue by calculate markup slightly more than $1 trillion on a conventional basis.